RESOURCES

What is Default Insurance?

When you are putting less than 20% down in Canada, your mortgage has to be insured through CMHC, Genworth

or Canada Guaranty. They provide lenders with default insurance in case borrowers default on their mortgage. Traditionally, if you were putting more than 20% down, you were able to avoid this cost as it was covered by the lender if required. The Government has implemented many rule changes which directly impact lender’s ability to rely on default insurance for conventional mortgages. Most lenders have now started classifying 2 categories: “insurable” and “uninsurable”. While they are still able to provide uninsurable products, most of those options now come with a higher rate attached. Here are a few examples of mortgage which can no longer be insured:

- Rental properties

- Refinances

- Amortizations longer than 25 years

- Applications that do not qualify using the Bank of Canada’s rate

- Properties over $1M

- Applicants with credit scores under 600

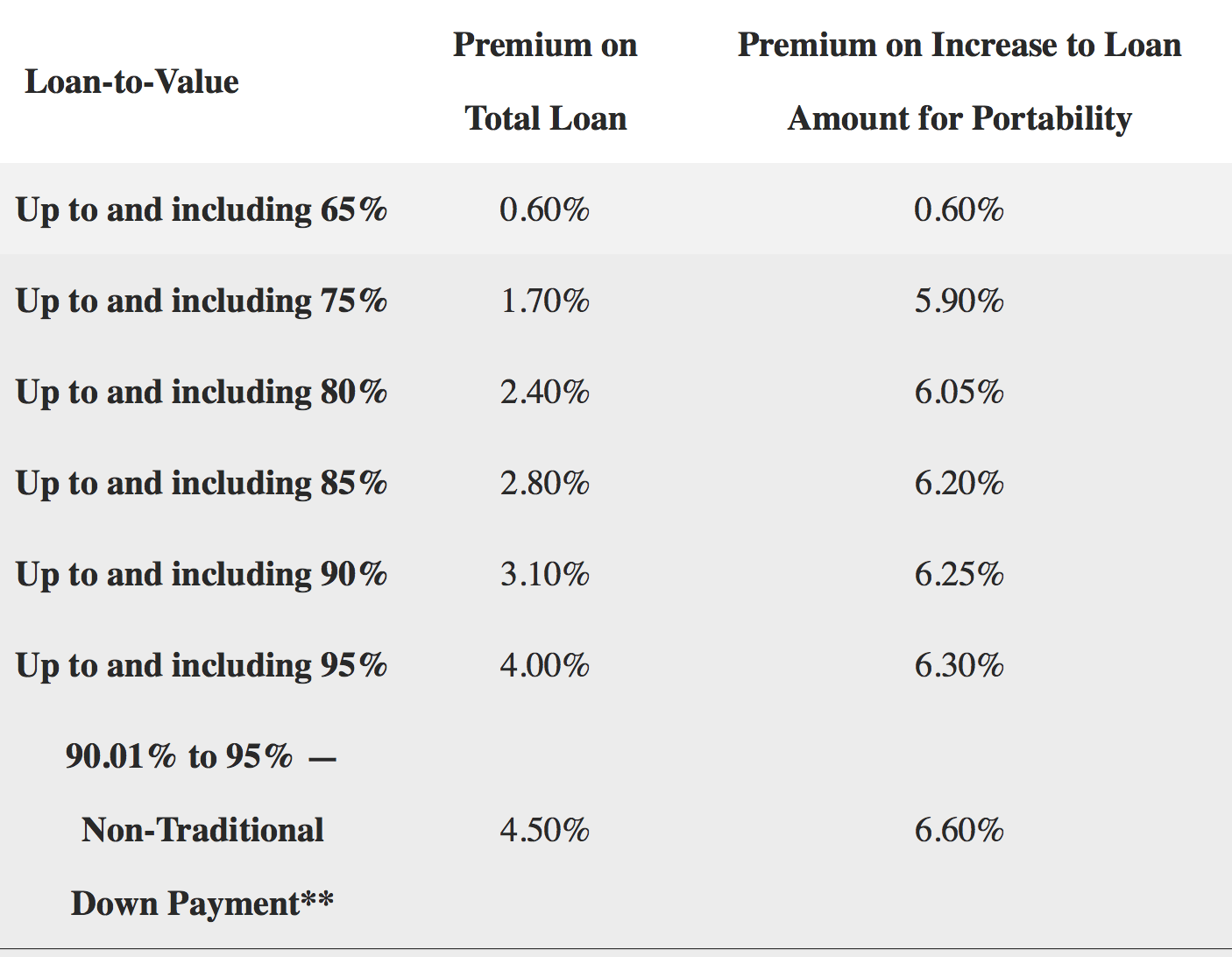

Here are CMHC’s current rate premiums which typically get added into the total mortgage: